Which is better, a pension or an ISA?

Pensions and ISAs are taxed differently, so it pays to know how to maximise the benefits.

9th March 2020 10:11

by Ceri Jones from interactive investor

Share on

Pensions and ISAs are taxed differently, so it pays to know how to maximise the benefits.

Everyone can have both an ISA and a pension – and as each type of tax wrapper has advantages and disadvantages, investors should try to make the most of both products.

The main advantages of both pensions and ISAs are their tax breaks. Profits on investments held in both are not subject to capital gains tax (CGT), and dividends received are also free of tax, which is worth 7.5% to a basic-rate taxpayer, 32.5% to a higher-rate taxpayer and 38.1% to an additional-rate taxpayer. The two products differ, however, in the way contributions are taxed on the way in and proceeds are taxed on the way out.

Contributions to ISAs are made out of net income. Pension contributions attract tax relief equal to the amount of tax you would have paid on the contribution. This is paid at your highest marginal rate, so basic-rate taxpayers can receive 20% tax relief on contributions, while higher-rate and additional-rate taxpayers can use their tax returns to claim an additional 20% and 25%, respectively.

- Learn more: What is a SIPP | ISA vs SIPP | SIPP Tax Relief Explained

However, the position is inverted for withdrawals. While all withdrawals from ISAs are tax-free, for pensions, 25% is tax-free but the remaining 75% is subject to income tax.

- Your guide to the state pension and how goalposts will shift in future

Pension tax-efficiency

All else being equal, pensions therefore enjoy a more favourable tax position and typically grow faster than Isas, because the government’s contribution is received at the outset, creating a bigger pot at an earlier time to benefit from investment growth and compounding.

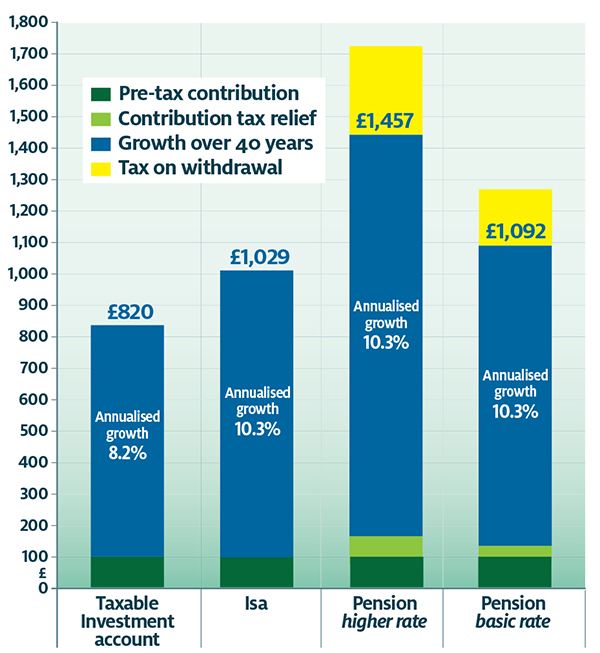

Looking solely at the tax position, we asked financial adviser Flying Colours to crunch the numbers, comparing the outcomes from saving the same amount for 40 years into a pension, an Isa, and an ordinary savings account without any tax breaks. The calculation was based on all investments growing by 6% a year, with dividend income of 3%.

Investing in an ISA produced an outcome 25% better than a taxable investment account; however, a pension will always trump an ISA (see chart below). “As you can see, pensions are superior, especially if you are a higher-rate taxpayer today,” says chief executive Guy Myles. The results over 40 years show an uplift versus an investment account of 25% for an ISA investor, 33% for a basic-rate pension investor and 78% for a higher-rate pension investor.

“In fact, the analysis assumes small ongoing tax on the unwrapped investment account growth because of dividends, but [it doesn’t take into account] CGT and is therefore generous in respect of that option. It is clear that pensions are a more efficient way to produce income in retirement than Isas, but this uplift must be considered alongside the loss of access to funds until you are 55. If you can cope with having your money locked away, it is an excellent choice.”

Pensions are certainly restricted by copious red tape. While funds cannot be withdrawn from a pension until age 55, withdrawals from an ordinary ISA can be made at any time. The exception is a Lifetime ISA (Lisa), from which withdrawals can only be made after age 60 or to buy the policyholder’s first home without suffering a 25% penalty. By last September, young people had been charged more than £9 million in penalties for taking money out of a Lisa prematurely.

What would happen to £100 invested over 40 years

Notes: Chart assumes investment growth 6% pa; dividend income 3% per annum reinvested; tax on dividend income 20% per annum (taxable account); 40-year investment; tax on pension withdrawals amounting to 15% (25% tax free plus 20% tax on the balance). Capital gains tax (taxable account) not included. Source: Flying Colours

ISA flexibility

An ordinary ISA offers much greater financial flexibility and can be drawn upon to meet small or major expenses such as a car purchase or a period of unemployment. This may be particularly helpful for younger people with few savings, whose career and relationships are more likely to be in a state of flux. ISAs also play a useful role in the provision of additional tax-free income if your pension income is near the upper limit for your tax bracket.

Furthermore, the government has said that the pension access age will be pushed back at the same pace as the State Retirement Age, moving to age 57 in 2028; there is nothing to prevent a future government hiking the age even more sharply in line with rising life expectancies.

There is also a big difference in the investment choices on offer. ISAs offer a huge range of investment options including funds, investment trusts, individual shares, cash, and even crowd-funding and peer-to-peer lending schemes. A self-invested personal pension (SIPP) provides access to a similarly wide range of investment opportunities, and like an ISA demands investment know-how and continual scrutiny.

In contrast, many employer pension schemes are linked to a small range of poorly performing funds, often run by insurance companies. Unfortunately, auto-enrolment schemes can be linked to some of the worst.

Generally, pensions are more suitable for higher-rate taxpayers. It is possible to contribute up to £40,000 per tax year into a pension versus £20,000 in an Isa, and higher earners receive their highest marginal rate tax relief on their contributions. It is very common for higher tax bracket employees subsequently to fall back into the basic-rate tax bracket in retirement, paying only basic-rate tax on withdrawals.

Moreover, we tend to think of pension tax relief as applying only to earned income (rather than dividends or pension income), but even someone without relevant earnings can contribute up to £3,600 in a tax year and receive relief on it. “Very few people seem to be aware that you can continue to make pension contributions in retirement until you are 75,” explains Myles. “If you are no longer earning, the maximum you can invest is £3,600 including £720 of tax relief. Given the significant benefits of a pension versus other tax wrappers, this is a good option for many people to boost returns later in life.”

There are also implications for inheritance tax, which is charged at 40% and payable on estates over £325,000. Currently, if you die before 75 and you have a defined contribution pension (i.e. a money pot, as distinct from a salary-linked pension), it is held outside of your estate and can be passed on to your beneficiaries completely tax-free. If you die after age 75, your beneficiaries pay income tax at their marginal rate on any pension funds you’ve left them.

This concession trumps Isas, which are counted as part of your estate and added to other savings and assets when you die. However, special rules apply in regard to your spouse or civil partner. Your partner is given a temporary one-off additional allowance equal to the amount you have saved in your Isa, on top of their own ISA allowance (currently £20,000 a year). This allows your ISA savings to pass to your spouse, who can deposit them into an ISA and retain their tax-shelter status. So, for example, if you had £50,000 in your ISA when you died, your spouse could deposit a total of £70,000 (£50,000 and £20,000) into an ISA in that tax year.

Inheritance ISAs

To be eligible, a claim must be made within three years of the death, or 180 days after the estate has been administered. A number of ISA providers accept ‘additional permitted subscriptions’ or ‘inheritance ISAs’, including Hargreaves Lansdown, Skipton, Nationwide and National Savings & Investments.

Pensions typically win when it comes to tax-efficiency – and a company scheme is a no-brainer if your employer makes generous contributions. However, if flexibility and accessibility are important, then the ISA comes into its own.

Compensation contrasts

There are big differences in compensation, should your provider collapse. If a bank, building society or investment provider goes bust, you are protected for up to £85,000 per institution under the Financial Services Compensation Scheme (FSCS).

It therefore makes sense to spread your money across different providers if you exceed these amounts, and ensure banks are not arms of the same overall corporate group, as the FSCS will only pay out £85,000 per person for each FCA-authorised institution.

In the event of a pension provider such as an insurance company failing, the FSCS will pay out 100% of your claim with no upper limit. Customers of failed SIPP firms can claim up to £85,000 for misleading advice, poor management or misrepresentation if they have lost money as a result and their adviser has since folded, although SIPP funds are ring-fenced from the SIPP provider’s own accounts. Occupational salary-linked pension schemes that become insolvent are covered by the Pension Protection Fund, which pays out a maximum of £39,006 a year capped at 90%.

This article was updated in January 2021.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.